In this post we will describe one of the best trading systems in our CME futures portfolio

This system trades gold futures (backtested for one contract), only long side in mean reversion, taking advantage of a seasonal pattern. It consists of 3 sets (filters and trigger) to get more trades

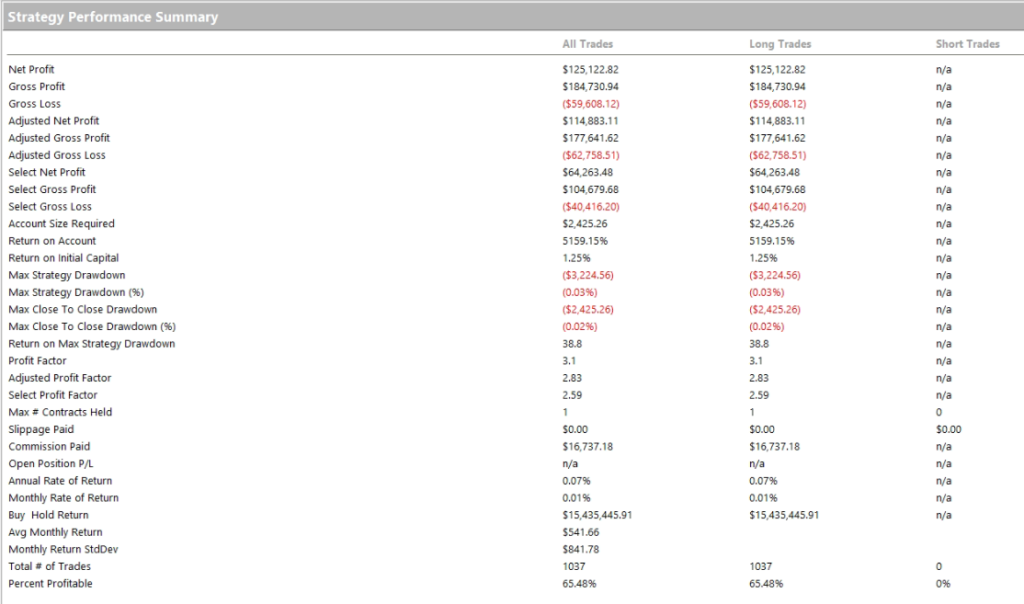

Below, some of the most important ratios are described, among which stand out:

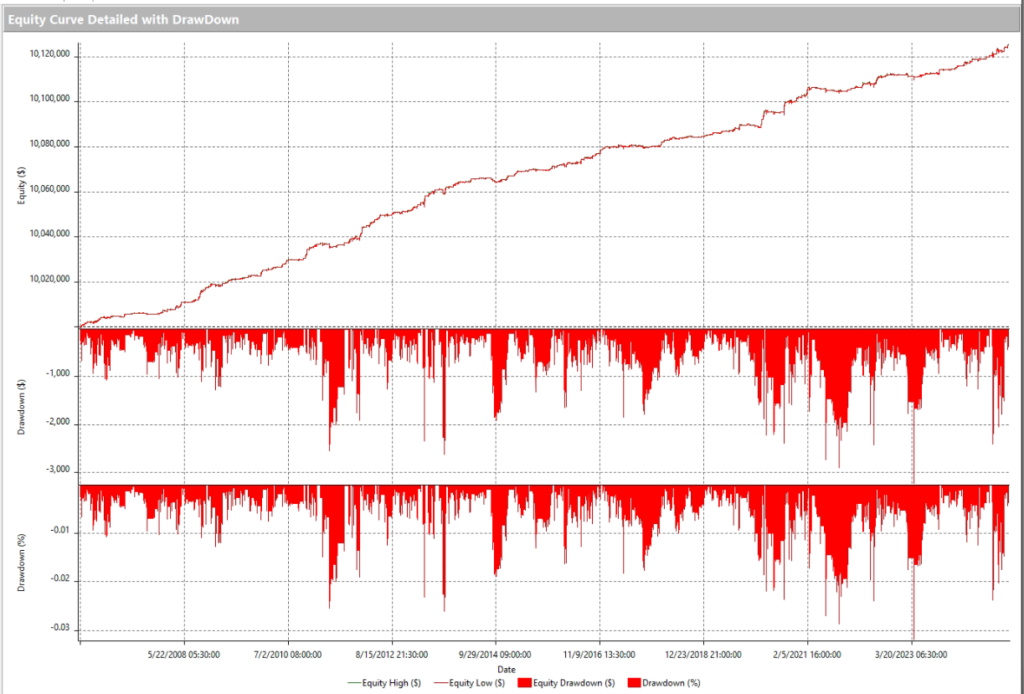

-Return on Max Strategy Drawdown: 38.8

-Profit Factor: 3.1

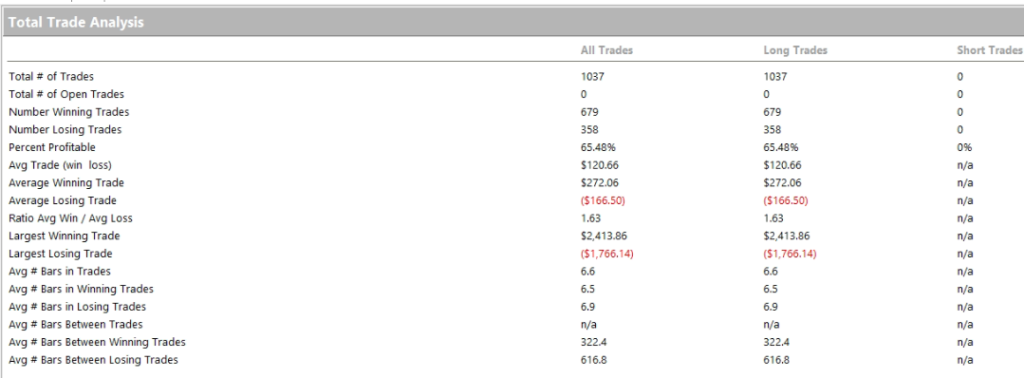

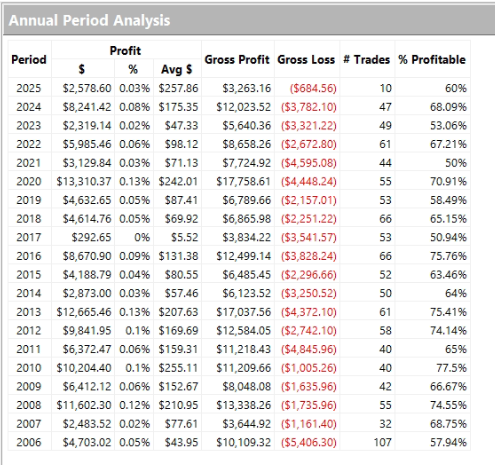

-Number of Trades: 1037

-Percent Profitable: 65.48%

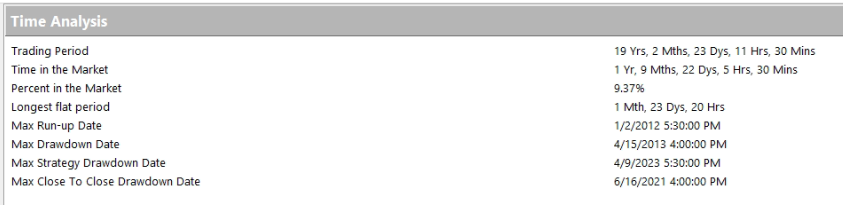

-Trading Period: nearly 20 years (from 2006 to nowadays) OOS period is from 2018

-Ratio Avg Win / Avg Loss: 1.63

-Average Trade: 120.66$ Taking into account commissions and slippage, which are included in the backtest (both totaled in the “Commission Paid” field)

-Average Bars in Trades: 6.6 So average holding time period is 3 hours 18 min

Below we see what the equity curves VS drawdowns look like:

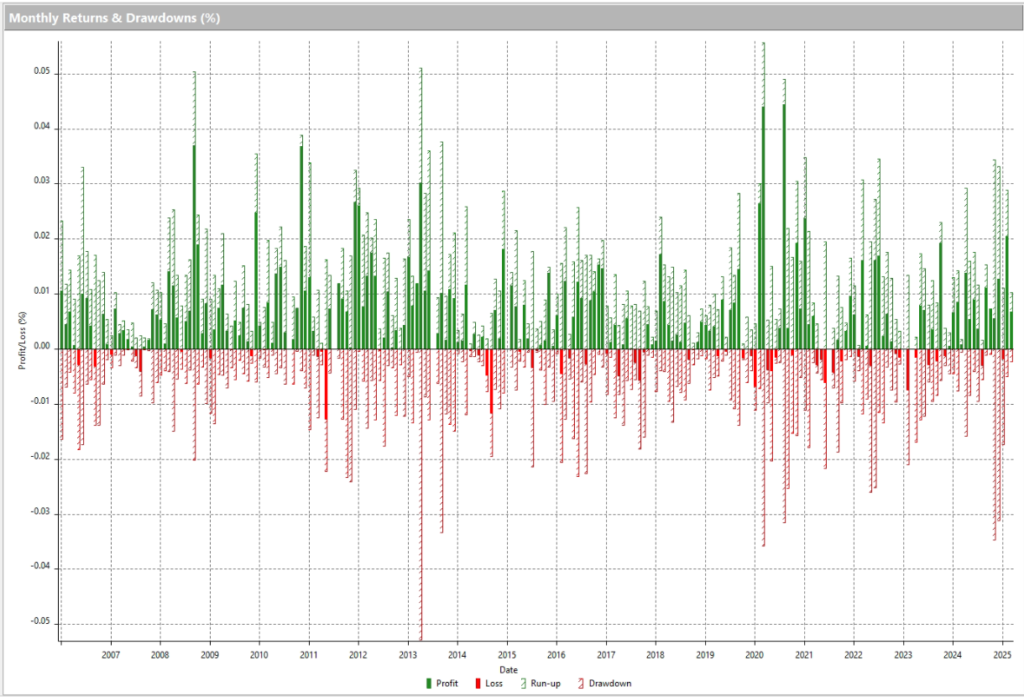

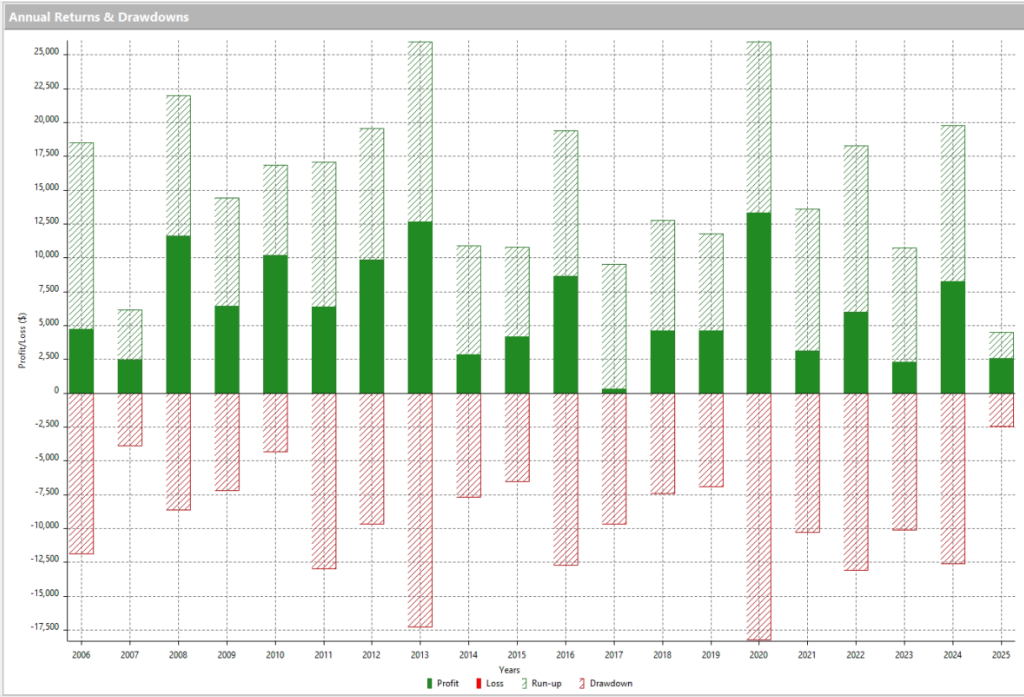

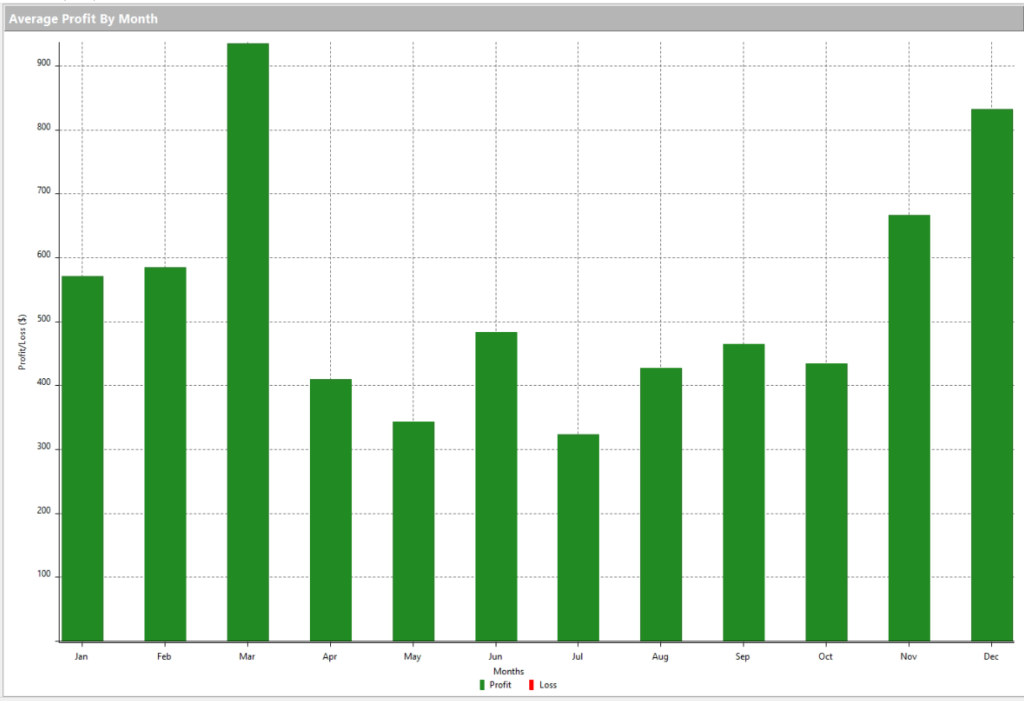

Regarding Periodical Analysis, we get the following:

In short, it is an excellent trading system, with the following key points (among others):

-Good ratios in general, as described

-Good trading execution. It uses buy limit orders in a liquid market like gold futures, which helps to reduce slippage

-Stability of Returns/Drawdowns

-Recently has performed new equity highs

-Large number of trades. Exploits a solid edge

It has been designed and retested using propietary True Alpha Systems methodology and knowdledge